The Cost of Living Well, Our 2017 Spending

It’s been over a year and a half since I quit my job. At that time, we calculated that we had enough investments to fund a $40k/year lifestyle indefinitely. Of course a lot has changed since then. For one thing, we travel a lot more. Over the past year, we enjoyed a decadent stay at an all inclusive in Jamaica, road tripped around Catalonia, hiked rural Vermont, swam with sharks in Belize, and just returned from a 3 week surfing trip to Costa Rica. I’ve also continued pursuing my hobbies including mountain biking, surfing in the Northeast, building a greenhouse, and growing a ton of veggies in my garden.

Getting more comfortable with being a bum

When I first quit my job, I still wasn’t completely comfortable with not having an income. Even though Mrs CK found a retirement gig that still covers our expenses and healthcare, there was something unsettling about not having my own salary. Without an income, the only knob I could turn on our finances was to watch what we spent. I wouldn’t say that I was holding back – the majority of our expenses in 2016 were travel related – but it was on my mind a lot.

Now I’m coming up on 2 years without working, and I’m getting more comfortable identifying as a jobless vagabond. The market has been doing better than we expected and I’ve found myself less concerned with money. If anything, the tables seem to have turned, and I have to stop Mrs CK from being too frugal on occasion.

I’ve been more apt to splurge, and less inclined to do anything that feels like work. Even when we do treat ourselves, it’s probably not what most would consider excessive – sharing a sandwich from our favorite deli, or picking up craft beers to enjoy at home.

We had a few Toppers.

We had a few Toppers.

Tracking our 2017 cash flow

Travel hacking has revolutionized the way we travel, but opening dozens of cards for sign up bonuses has also complicated our expenses. We used to have one credit card for everything, but now things are getting a bit messy.

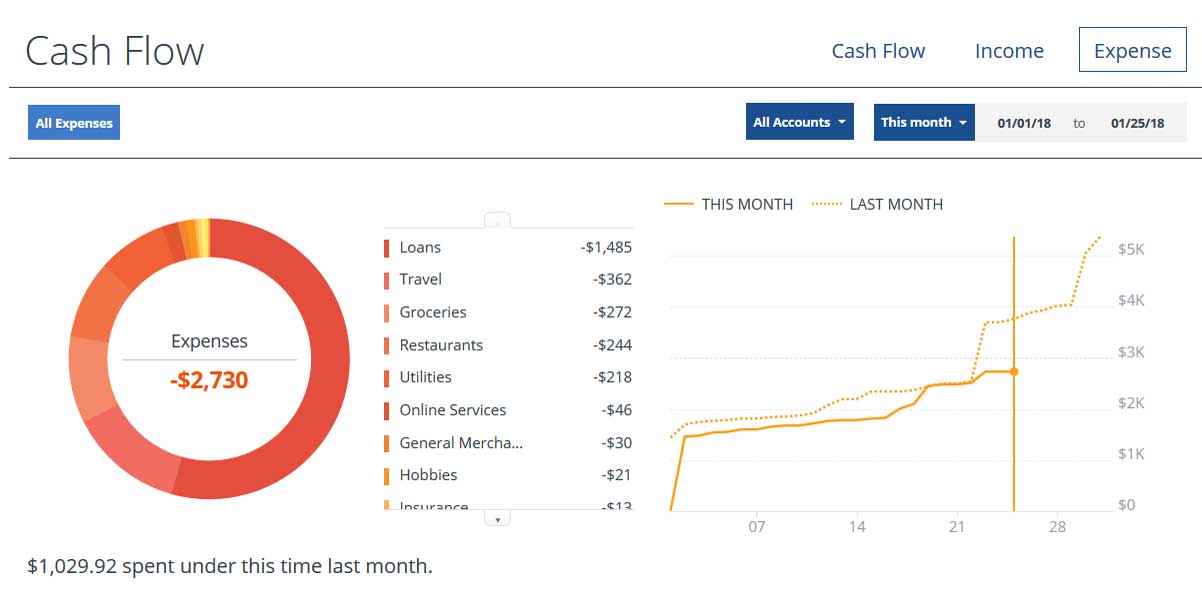

At the beginning of 2017, I revived my old Personal Capital account. Each time I get a new card, I simply add it to my dashboard and the software tabulates all of our expenses into basic categories.

Here’s what our cash flow looks like for this month:

Our 2017 cost of living

Our total cash flow from 2018 as was $43k, but this includes principal payments made on our mortgage, including some extra payments we started making. When I update the numbers to reflect our actual costs we get:

| Month | Year | ||

|---|---|---|---|

| Housing | $1,118 | $13,411 | |

| Mortgage Interest | 496 | 5,956 | |

| Taxes & Insurance | 530 | 6,355 | |

| Renovations & Repairs | 92 | 1,100 | |

| Travel | $379 | $4,547 | |

| Food | $425 | $5,099 | |

| Groceries | 287 | 3,447 | |

| Restaurants | 138 | 1,652 | |

| Utilities | $249 | $2,984 | |

| Electric | 126 | 1,512 | |

| Oil | 35 | 418 | |

| Water/sewage | 47 | 560 | |

| Internet | 41 | 494 | |

| Cars | $202 | $2,423 | |

| Insurance | 93 | 1,117 | |

| Gas | 82 | 987 | |

| Maintenance | 27 | 319 | |

| General Merchandise | $220 | $2,642 | |

| Entertainment | $164 | $1,969 | |

| Beer | 150 | 1,800 | |

| Netflix | 6 | 70 | |

| Amazon Prime | 8 | 99 | |

| Hobbies | $122 | $1,468 | |

| Gym | 28 | 333 | |

| Brewing | 18 | 210 | |

| Greenhouse/Gardening | 58 | 700 | |

| Surfing | 15 | 185 | |

| Mountain biking | 3 | 40 | |

| Student Loan | $100 | $1,200 | |

| Google FI Cell Phones | $52 | $619 | |

| Gifts & Donations | $50 | $600 | |

| Clothing & Shoes | $40 | $477 | |

| Healthcare | $17 | $200 | |

| Belize Clinic | 50 | ||

| Total | $3,137 | $37,639 |

For comparison, we spent just over $38k in 2016. The biggest reduction in our spending came from travel expenses. We spent $4.5k in 2017 compared to $7k in 2016. This is because our trips to Jamaica and Spain were completely free. We pretty much got over $10k in free travel just by signing up for new reward cards every few months.

We had some incredible free trips.

We had some incredible free trips.

While we had a big reduction in our travel spending, we did spend more in other areas. I spent $650 building a greenhouse, bought some surf gear, and enjoyed a lot more local craft beers.

The key to living well for less

In reality, we have been living a much richer lifestyle than $40k would reflect. That’s because we’re always honing ways to do more with less. If it wasn’t for all the travel hacking, acquiring free furniture, driving $3k cars, and cooking gourmet meals at home with friends, our lifestyle would cost double what we spend.

We didn’t get to a spending level like this overnight. For years, we’ve been trying new things and testing our limits. It’s never been about deprivation so much as finding optimizations that work for us, and we keep getting better at it.

Wealth to me is no longer about fancy cars and expensive bars, it’s about sleeping in whenever I want, having time for friends and family, being free to surf out the winter in a tropical paradise, and being excited to find a free toy in the trash.

The truth is that we don’t even pay much attention to our spending anymore. Maximizing happiness per dollar has become part of our lifestyle, a lifestyle we’re enjoying immensely.