How Much Do I Need to Retire Early?

Traditional retirement calculators assume you suck at money, and the results they spit out are always depressing. But when you adopt an early retirement lifestyle and spend only a fraction of your income, it’s easy to retire much earlier than most calculators predict.

Retiring early is easier than it might seem.

How much money do you need to live well?

Lower spending means less assets are required to support a lifestyle. However, a lot of us have great ambitions to travel and see the world. We want the confidence that once we quit our cushy jobs, we’ll have enough to live well. You don’t want to be forced to stay at home eating ramen noodles to survive – even if you love noodles and being lazy…

A good place to start is by tracking how much you spend now. If you haven’t already, start tracking data on your total spending and net worth each month. We don’t bother with a budget, but we do know how much we spend in a year.

Start testing your retirement budget

You’ll have a much better picture of your retirement spending if you start living as close to your dream retirement life as possible before you quit.

On our journey to financial independence, we did work and save a lot, but we also pursued our passions as much as possible – we just found ways to do them cheap.

Chillin’ on the cheap in Puerto Rico

Chillin’ on the cheap in Puerto Rico

By the time we quit our jobs, we had a very good idea how much it would cost us to practice our hobbies, eat and drink like kings, and go on tropical vacations like surfing in Costa Rica multiple times a year. So far, our spending has looked about the same, if not a bit less than when we were working.

How will you fund your retirement?

Once you have a good idea of your annual spend, it’s time to figure out how to cover it. There are many investment vehicles out there, and different methods for calculating how much income can be provided reliably.

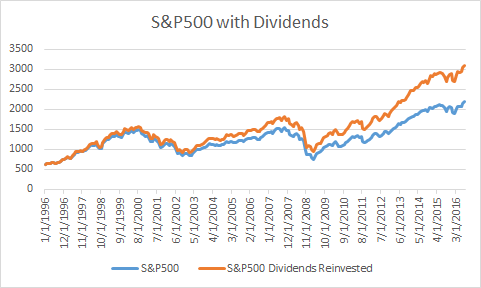

We like our investments to be efficient and hassle-free. The majority of our assets are in a three fund stock portfolio. Basically, we own a chunk of every major corporation out there. The highly educated and well-paid CEOs and managers of the world are working their asses off to grow our investment and return profits.

Predicting stock market returns

While investing in stocks through index funds is easy and effective, predicting how the market will perform is impossible. Next year could be the best year ever, or we could have a major crash like the one we saw in 2008. We need to know how much we can withdraw from our portfolio on a regular basis and still survive the bad times.

Engineers designing infrastructure face a similar conundrum. Mother nature is unpredictable. Nobody knows how big the next flood or hurricane will be, and yet we still have to build bridges and dams that stand the test of time.

Designers simply use historical data to determine safe sizing. For example, a 100-year flood is a flood level that only has 1% chance of occurring based on historical data. A 50 year flood is flood level that has a 2% chance of occurring any given year.

It’s going to be a lot cheaper and faster to build structure to handle a 50 year flood, but there is a higher chance a rogue storm will take it out.

How do we determine safe withdrawal rates for stocks?

Calculating the probability that a portfolio can survive a retirement during the worst recessions in history was the basis behind the Trinity study. It looked at how different portfolio allocations and withdrawal rates would have performed over a 30 year period starting at different times in the stock market’s history.

This is a great starting point, but 30 years is going to be too short for many early retirees. Luckily, even more work has been done on the subject. Fellow blogger Early Retirement Now took the time to dive deeper, studying historical performances of portfolios for up to a 60-year time period.

These studies generate probabilities of success – you just have to decide what kind of risk you are comfortable with. Do you stay conservative and build to a 100+ year flood, or can you get away with something less that might only handle a 50 year flood?

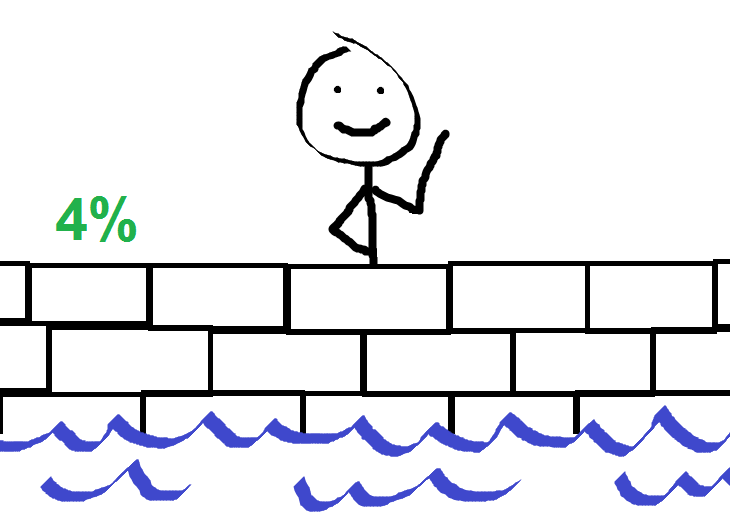

A 30 year retirement: 4% withdrawal rate

A 4% withdrawal rate is kind of like a 30-year retirement water mark. Based on what we’ve seen the market do, a portfolio of 75% stocks and 25% bonds has a 99% chance of making it 30 years.

That’s pretty good, but there’s also a 15% chance you’ll completely run out of money in 60 years.

That’s pretty good, but you might need to breakout the sandbags in a big storm.

That’s pretty good, but you might need to breakout the sandbags in a big storm.

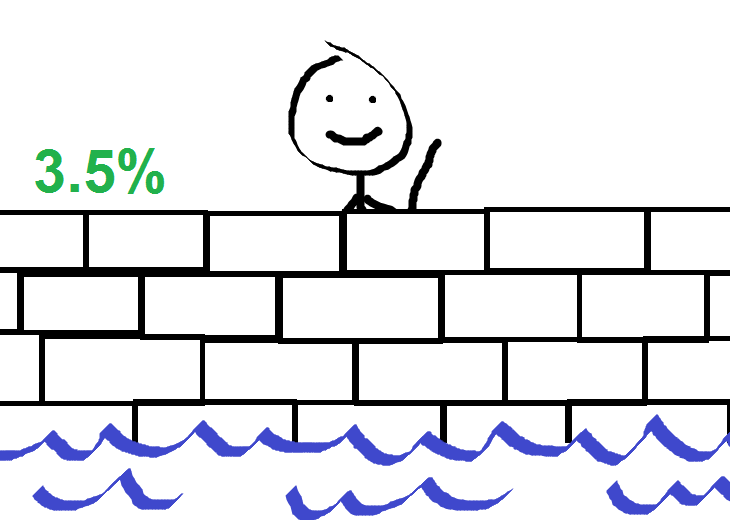

A 60 year retirement: 3.5% withdrawal rate

A 3.5% withdrawal rate is like a 60-year retirement water mark. A portfolio of 75% stocks and 25% bonds has a 97% chance of making it 60 years. There is also a 93% chance you’ll still have all of your money – or more – after 60 years.

That should do it.

That should do it.

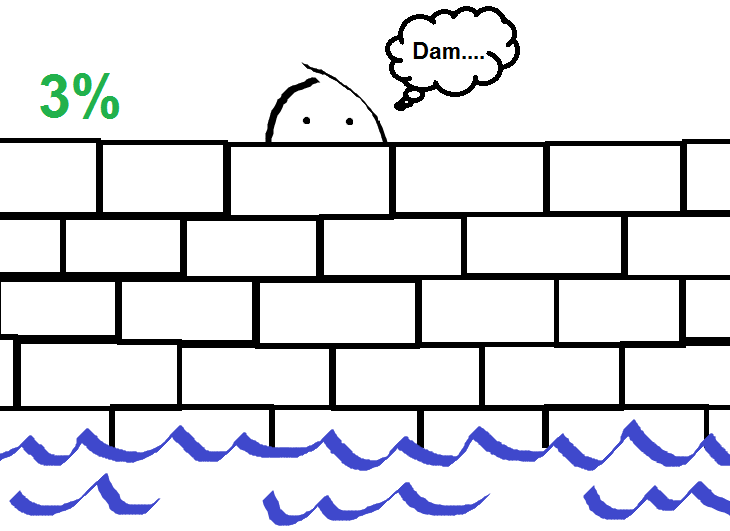

I wanna die rich: 3% withdrawal rate

A 3% withdrawal rate is like a 100+ year water mark. Historically, we have never seen a recession so bad that a portfolio of 75% stocks and 25% bonds would have ended up being worth less than what you started with after 60 years. Obviously we don’t know what the future holds, but historically speaking, that’s pretty solid.

Yeah, you’re good…

Yeah, you’re good…

So how much do I need to retire early?

To figure out how big of a portfolio you need, just take your budget and divide by the withdrawal rate. For a $40k budget, the amounts you would have to save are as follows:

$40k ÷ 4% = $1 million

$40k ÷ 3.5% = $1.14 million

$40k ÷ 3% = $1.33 million

While it sounds nice to have an invincible portfolio, saving additional hundreds of thousands of dollars can take some time. The odds are still pretty favorable for the 4% rule, and really good for the 3.5% rule.

Optimally, I would die having spent my last penny, or maybe even in debt – take that banks. But I know my brain loathes uncertainty and won’t let me optimize that much. For me, a 3.5% withdrawal rate is more than safe enough.

The thing is, some flexibility might allow you to retire earlier. Even with the 4% rule, there is 81% chance you’d end a 60 year retirement with a portfolio the same size or even bigger. You could always tighten your budget during a recession, or go back to work while stocks are on sale. Earning a little supplemental income could also get you back down to a safer withdrawal rate.

The trouble with making these decisions is the possibility of regret later in life. If you retire earlier, there is a chance of running out of money. If you work longer, you might run out of time. When making this decision, it may be helpful to consider that most older people wish they had traveled more, worked less, spent more time with friends and family, and taken more risks.