My Journey to Financial Independence

Growing up, my parents had extended periods of unemployment. We could have been better off financially, but we always had a home in my grandfather’s house, and never went hungry. The worst I suffered was the embarrassment of wearing my sister’s old clothes to school. Kids can be mean, especially to a smart ass wearing bad girl’s clothes – my sister didn’t exactly get to pick them either. While the 8 year-old me was pretty miserable, now I appreciate having learned the importance of money early in life.

Checking out the Meow Wolf exhibit in Santa Fe a few weeks after quitting my job.

Checking out the Meow Wolf exhibit in Santa Fe a few weeks after quitting my job.

Getting my first job

I started my first job serving coffee in a cafeteria when I was 14. It wasn’t awesome, but earning $30 a day was infinitely more than nothing. I made my first investment with that cash. The CD rates at our local bank were 5%, and I remember thinking if I could invest $1000 in a CD, it would pay me $50 a year for doing nothing. Since I preferred playing video games over serving coffee, I really liked the idea of making money without working.

That first job was followed by an equally mind numbing stint at Walmart before I got a job cutting lawns. I didn’t like my first two jobs, but I loved landscaping. I enjoy working with my hands, and being outside all day surrounded by the smell of fresh cut grass was the best. The 10-hour days flew by, and earning $8-10/hour was enough to cover my college tuition.

Working through college

I went to college to become a computer engineer in 2000 – right when the dot com bubble was bursting. At that time, I didn’t even know what a bubble was. I’d chosen my major because it was the highest paying 4 year degree. I was chasing money – partly because I was scared of struggling for it. When all the internet jobs disappeared, my plan for targeting a high salary wasn’t looking so ingenious.

I was fortunate to secure a last minute internship working on helicopters. I only got the job because my boss was too late recruiting aerospace interns, and I was willing to come in after the semester had already started. The $14/hour pay really helped with tuition, and I quickly picked up a lot of skills in a whole new field. That internship led to a $52,000/year job when I graduated.

My first real job

Getting a real job was a huge weight lifted off me. I celebrated my success by going out to eat, buying toys, and spending late nights at bars whenever I wanted. After working for a couple of years, I saved enough money to buy a house and a new car.

Expenses were adding up, but I could easily afford them. The new car payment was $350 a month, and my insurance costs had doubled. My mortgage wasn’t too bad – I got roommates to help cover the payment. I enjoyed having the company, and we threw some epic parties. Some of those roommates are still my best friends today.

With my fancy new job, I also took on the mentality that any item under $200 was chump change. Clothes, shoes, toys, and especially drinks at the bar all seemed like minor purchases. Maybe I was making up for all the time I spent dressed like my sister in elementary school.

I was 23 and living it up.

The eureka moment

While visiting home, I got to talking about money with my younger brother. He went to community college and was working as a waiter. I was caught off guard when he told me that he’d already saved $60,000.

That amount of money sounded enormous to me. People our age only had student loans that size. He didn’t get lucky in stocks or real estate. This was all money he’d earned and saved while working as a waiter. Barely out of school, no fancy degree, he was killing it.

Mind blown, I started to think about how I could do the same. I didn’t need to earn more, I needed to spend less – a lot less.

Getting spending on track

It was easy getting used to my salary, but upon reflecting, I remembered this was an insane amount of money to be making. The 14 year old me would have been wondering why the hell I didn’t already have $100k invested and earning interest. I was making over $60k/year at this point and spending a good chunk of it. In college, I lived on a fraction of that.

I really started turning things around when Mrs CK and I got married. I was cheap, and we were both lazy. We decided to skip the wedding and got married at city hall for 20 bucks. Instead of spending on a big ceremony, we went on several honeymoon vacations.

Mrs CK said she married me for my brain (I think that’s just what you tell engineers) and not my fancy new RSX Type-S. I sold the car for $10k less than what I paid for it, dropping a car payment, and halving my insurance costs. It was replaced it with a $3000 Honda Civic – the same kind of car I had in college.

Getting investing on track

Our way of life didn’t change much, I still had a perfectly fine car, and we still ate and drank well – just at home. The big difference was in our savings. We began to max out our 401k contributions and cash was piling up in our bank accounts.

I learned to make pizzeria quality pizza at home.

I learned to make pizzeria quality pizza at home.

Our savings rate was good, but our investing still wasn’t at its best. I was trading in and out of stocks, using options to leverage bets. It wasn’t long before I realized my automated 401k investments were doing a lot better than my trading. A big part of the problem was that too much cash was sitting idle while I found the “right” stocks to buy.

We changed strategies, and I closed all my trading accounts. Instead of being stock pickers/traders, we decided to stick with index investing for the long term. We thought the market was too high back in 2012, but following our new strategy, we invested everything in a three fund portfolio.

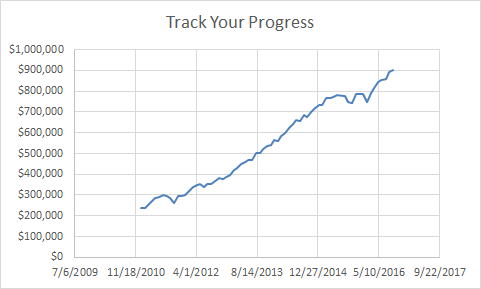

Set it and forget it

Cash that was sitting idle finally got to work. Index fund investing was much simpler and stress-free. A lot of my mental bandwidth was freed up for more enjoyable hobbies. Our simple strategy started paying off as the market headed into a long bull run.

The only thing to do with automated investments is track progress.

The only thing to do with automated investments is track progress.

The lowered stress started to spread to other parts of our lives. I always had a fear of struggling for money, and having solid investments gave me added confidence. At work, I started turning down extra responsibility leading stressful projects. I changed positions to pursue research projects that interested me, and started wearing jeans and crazy kicks to work.

Earlier in my career I had room for inventing and learning, but as you move up in engineering, you also stop doing the fun work. Now I had a chance to be creative again. I invented and applied for over half a dozen patents in 2 years. I was actually enjoying work again for a change.

Finding freedom

When the Mrs and I got married in 2008, we created our first plan to reach financial independence. Our goal was to quit our corporate jobs by 2020, which we thought was aggressive. Thanks to constantly questioning our strategies, and optimizing our spending, we hit our goal a few years early. Mrs CK quit her corporate job to follow her passion teaching at a community college, and a year later I quit my job.

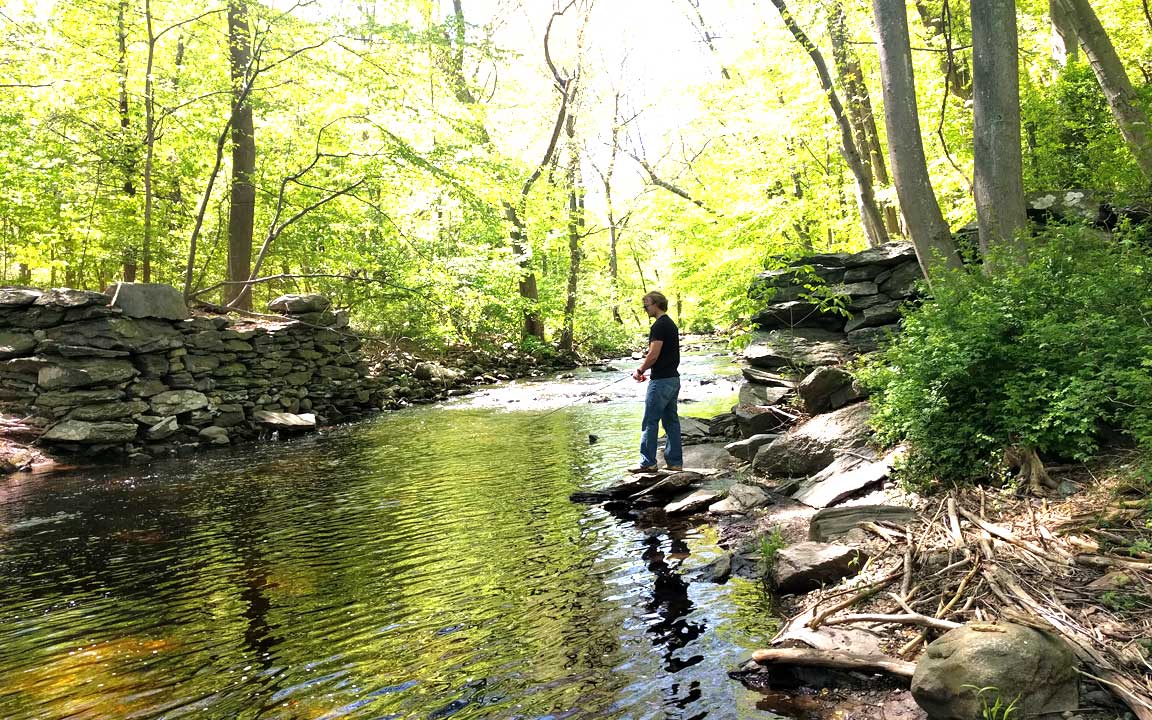

Fishing at the park last week.

Fishing at the park last week.

I didn’t make any lucky bets, and we didn’t work anymore than our day jobs. All the fancy investing tricks I tried only slowed us down. Looking back, I was probably drawn to riskier investing schemes because saving hundreds of thousands of dollars seemed insurmountable.

Maybe some people do find that quick fix starting their own business, picking hot stocks, or making stellar real estate deals. But my path involved a regular salary, not so regular spending, and boring investments. The benefit of boring was that we also had plenty of time to travel, party, and keep learning new hobbies. It did take us years, but we didn’t have to make sacrifices, just better decisions.