Screw the Roth, Max Your Pre-Tax!

You don’t have to go to the Caribbean for your tax shelter.

You don’t have to go to the Caribbean for your tax shelter.

It’s no big secret that large corporations hate paying taxes, and corporate accountants are very good at utilizing all available loop-holes to avoid doing just that. One common trick corporations use is moving their profits offshore to a tax haven. This can be done by selling all their patents to a subsidiary in a tax haven country, then paying that subsidiary for “using” its intellectual property. Might seem shady, but right now moving profits around like this is perfectly legal.

In most cases, these companies will keep the profits offshore until they see an opportunity to bring money back without paying high taxes. Even if they need cash, they will resort to taking out loans or selling stock to raise cash before paying the 35% corporate tax they owe the US government. They are further incentivized to do this because in 2004, the US Congress enacted a repatriation tax holiday for corporations. For a limited time, corporations were given a 5.25% tax rate for repatriated profits. They were able to keep 94.75% of their money, rather than paying 35% and walking away with 65%.

If that doesn’t seem like a lot, paying 29.75% less tax means keeping 46% more cash ( (94.75/65)*100% = 146%.) If they had paid the full 35% tax up front, they would have had to generate 46% more income to end up with that same amount of money. Obviously, many corporations took advantage of the tax holiday, and now with the anticipation that congress may give them another tax holiday, they keep their cash offshore and wait.

Big corporations have the advantage here, but there are some tax games that those of us on our path to financial independence can and should be playing. These tax games are less shady. In fact, they simply take advantage of programs the US government has created to help us reach retirement. Pre-Tax accounts like the 401k, 403b, 457, HSA, and Traditional IRAs are our tax havens. And by utilizing them, we can also hoard away cash in anticipation of our own retirement tax holiday.

Pre-Tax accounts like the 401k or 403b can be converted to traditional IRAs. So to keep things simple, I will simply refer to Roth and Pre-Tax accounts.

So why hate on the Roth?

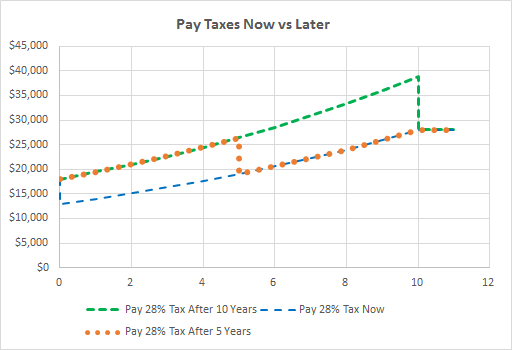

A Roth sounds great – no taxes forever on all the growth in your account is nothing to sneeze at. And with compounding interest, that can be a huge sum of money. But whether you pay 28% taxes now on your initial investment, 28% after 5 years, or 28% after 10 years, you will end up with the same amount of money. Taking away a set percentage of your portfolio has the same effect no matter when it happens, even if you have compounding interest. So if the tax rate is the same now as it will be in retirement, then Roth and Pre-Tax have the same advantages.

Paying 28% tax at different times, with 8% compounding interest for 10 years

Paying 28% tax at different times, with 8% compounding interest for 10 years

However, for a tax holiday strategy, you want to put off paying your taxes until you can pay them at a much lower rate. If you are on the path to early retirement, you will most likely be in a lower tax bracket when you get there. If you are making $100k and living off of $40k, then you have a healthy savings rate of 60% (which can get you to FI in 12 years – see here) and probably plan to continue living on $40k in retirement.

The money you put into your Roth accounts comes off the top of your income and is taxed at the highest marginal rate. For a single filer, earning $100k with standard deductions, the marginal rate would be 28% (based on 2016 tax rates.) In this case, If you take $18k off the top of your income, it would be taxed at 28% and you would have $12,960 to put in a Roth, or you could just put the entire $18k into a Pre-Tax account.

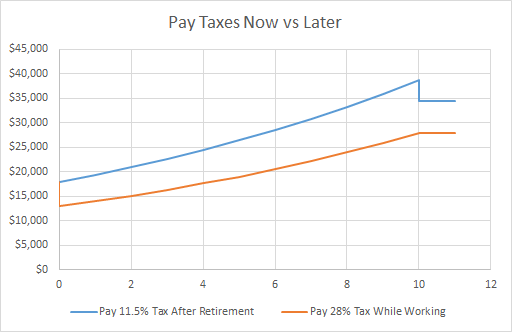

Years later in retirement, you might withdraw that money from your Pre-Tax account to fund living expenses. For a single tax payer with standard deductions, $40k of income would have an effective tax rate of 11.5%. This effective tax rate is much lower than the marginal rate you would have paid on that money while working. The effective tax rate for $40k of income is low because you pay 0% tax on deductions, and the rest is taxed in 10% and 15% tax brackets. Paying the effective tax rate of 11.5% in retirement leaves you keeping 88.5% of your initial investment verses paying the 28% top marginal rate while working and putting only 72% of your money in a Roth. By waiting to pay taxes until retirement, when income is much lower, the Pre-Tax account will be worth 23% more ( (88.5/72)*100% = 123%) than the Roth.

Paying tax in retirement vs while working, with 8% compounding interest for 10 years

Paying tax in retirement vs while working, with 8% compounding interest for 10 years

This is just a conservative example – you can optimize even further. Any income below your deductions, whether you use a standard deduction ($6,300 for single filer) or itemized deductions, is taxed at 0%. So during retirement, if you only withdraw from your Pre-Tax account an amount less than your deductions, you will pay no taxes on it. The rest of your expenses could be covered by cash from after-tax accounts. Long-term capital gains and qualified dividends in after-tax accounts are taxed at 0% for the first two tax brackets.

That would allow you to keep 100% of your money versus the 72% you would have put in your Roth. That’s 39% more cash – one hell of a tax holiday.

Will I have too much money locked up in my 401k in early retirement?

As mentioned earlier, money in pretax accounts like the 401k or 403b can be converted to traditional IRA accounts. And there are multiple ways you can access the funds in a traditional IRA well before you are 59.5 years old with no penalty.

You can setup a SEPP (Substantially Equal Periodic Payments) where you have a fixed amount distributed from your IRA penalty-free every year. There are several formulas the IRS has for calculating how much can be distributed each year, and the payments must be distributed for a minimum of 5 years.

Another, better option is a Roth IRA conversion ladder. In this case, you roll your 401k into a traditional IRA when you leave your job, then transfer some amount into a Roth IRA annually. This converted amount is taxable, so it should be optimized according to your tax strategy. The principal can then be withdrawn from the Roth IRA after 5 years without penalty. Do this every year and you can have steady withdrawals without paying a penalty.

There are many other cases for which the IRS allows you to tap into your 401k funds without penalty. Even if you need the money for some other reason early into your retirement, you could just pay the penalty. The 10% early withdrawal penalty and 11.5% tax rate still leave you with more money than paying a 28% tax to put that money in a Roth.

Is there any case to contribute to the Roth?

Compared to after-tax accounts, the Roth IRA still has the advantage of tax-free growth. But if you invest in equities in your after-tax accounts, such as a total market index fund which pays ~2% in dividends yearly, only the dividends will be taxable while the account grows. The taxes on capital gains wouldn’t be due until you sell. By paying a small amount of tax on dividends to keep the money in an after-tax brokerage account, you could have the full sum available in early retirement.

Furthermore, if you end up in the first two tax brackets during retirement, your capital gains and qualified dividends tax rate will be 0%. In this case, the Roth has no advantage over a traditional taxable brokerage account holding equities. Investments that generate taxable income, such as bonds and REITS, can simply be held in your Pre-Tax account.

Where the Roth does make sense, is if you are currently in a low tax bracket and plan to be in a higher tax bracket in retirement.

Work less, and retire sooner.

I know it might feel better to pay your taxes now, and not have to worry about them later. But waiting patiently for a retirement tax holiday is an extremely powerful tool. Tax avoidance strategies yield guaranteed gains, and saving 20-50% more means shaving years off your journey to Financial Independence.

It’s tough getting here, I’m not working any more than I have to.

It’s tough getting here, I’m not working any more than I have to.

If for some reason your 0% tax holiday in retirement never comes… awesome! That means you somehow have unexpected extra income. Even if you hit the point of having Required Minimum Distributions, your effective tax rate in retirement will most likely be less than your marginal tax rate while working. And until then, the money you stored away in Pre-Tax accounts can be your cushion that keeps growing without costing you anything in taxes.