Is the Stock Market Getting Too High?

With 9 years of awesome returns, we’re in the longest bull run in history, and the market is higher than ever before. While I’m enjoying the good vibes, I’m also worried about whether the market can handle being high as a kite.

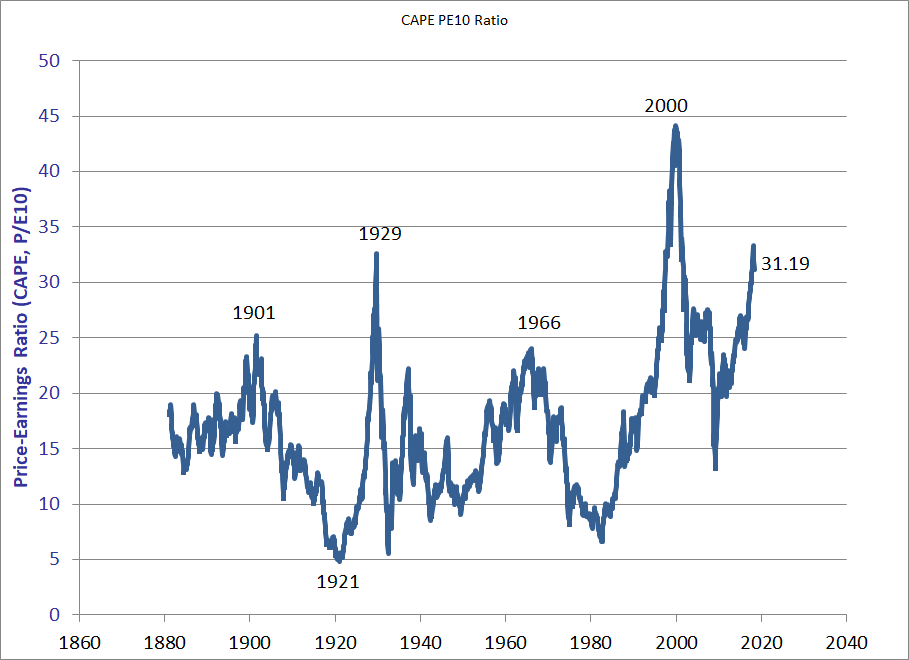

Gauging the market’s highness using CAPE

The market is higher than it’s ever been, but a growing economy and increasing corporate profits have given it the tolerance to keep getting higher. Instead of just looking at how high the market is, we need to consider exactly what we are getting for our money in terms of earning power. The easiest way to do this is by evaluating the market’s price after adjusting for earnings using a P/E ratio.

The PE is the price you pay for a company divided by how much it earns. For example, if you pay 10 golden eggs for a goose that lays 1 golden egg a year, that goose would be able to earn its own value in 10 years, and would have a PE of 10. That’s pretty good.

Like the market, your goose’s egg production might also be erratic. There might be a 0 egg year followed by a 2 egg year. We can get a better picture of that goose’s value by looking at its average laying over 10 years. When you compare the market’s price with average earnings over the past 10 years, you get what’s called the CAPE or PE10.

CAPE data from my neighbor Robert Shiller

CAPE data from my neighbor Robert Shiller

Adjusting for earnings, how high is the market?

Compared to the entire market history, the CAPE has also been trending higher in general. As of writing this post, here’s how the current S&P500 CAPE compares to historic averages:

- 32.0 – Current CAPE

- 16.9 – CAPE over market history

- 20.0 – CAPE over last 50 years

- 25.0 – CAPE over last 30 years

Depending on how you want to look at the data, the market could be at a “I can’t feel my legs” high, or just a little high… Of course things might be better than what the CAPE predicts.

For one thing, the last 10 year of earnings includes data from a massive recession. They also don’t have the new corporate tax cuts baked into them. If we look at more recent data like the current PE and the PE5 (with the average of the last 5 years earnings,) things look a bit better.

- 24.6 – Current PE

- 26.0 – Current PE5

Still, these numbers are above average, and I think it’s safe to say the market is flying high…

Now, that doesn’t mean we are headed for an imminent crash. Just like someone that’s had one too many brownies, this could play out a few different ways.

The market could just couch-lock

One scenario is that the market takes a break to chill out for a while. Instead of seeing the meteoric gains we saw last year, stock prices could just keep a more mellow pace.

Things are actually looking good for the economy. Unemployment is low, and corporations just got one hell of a tax cut. If earnings continue to grow while stock prices are couch-locked, the market will sober up as CAPE returns to the mean. In this scenario, the market could just keep getting higher without incident.

Unfortunately, the market hasn’t always been so laid back.

The market might have to crash

Of course, there is a chance that the market has already bitten off more than it can chew. Maybe there are some bad student loans it wrapped in with its cheese, or maybe some skunky trade wars freak it out. Whether it’s paranoia kicking in, or just too much of a good thing, the market might not be able to handle this party.

In this case, the market might start stumbling around – kinda like it is now – and then crash hard. It might be a little scary, but after a good snooze, the market will be back to getting higher than ever.

While this isn’t the most graceful way to conduct business, it’s what the market has been doing since its inception. Based on the market’s history, a 50% drop in stock prices is quite possible.

The market might kiss the sky

While it might feel like stocks are stratospheric right now, the prices aren’t exactly the highest in history. Right before the dot-com crash, the CAPE reached a high of 44.

That’s the thing with the market – it’s not always rational, and sometimes it just rips. While the euphoria of hitting extreme highs might be short-lived, you wouldn’t want to sit that party out.

If the market is high, should I pull out?

I don’t want to lose half of my money, but there could be more to lose by sitting out. I’m a long-term investor for good reason. Back in 2013, I felt the exact same way about the market. From 2009-2013, the market had doubled in value. At the time, the CAPE was sitting at 22, lower than today, but well above the historic average of 16.9. To me, all the signs were saying that the market was blitzed, and an impending crash was coming.

If I had bet on what I thought was going to happen – and what I thought the market signals were telling me – I would have missed another 70% increase in stock prices. Trying to time the market – even with CAPE data – is asking for a bad time.

Now, while I’m not pulling out of the market, I am re-balancing. I have all of my investments accounts linked in Personal Capital making it easy to check my allocations of stocks and bonds. If things look a little stock heavy, then I might swap some investments around to get back to my desired allocation.

Using CAPE to forecast future returns

Whether the market crashes or gets blasted into space, eventually we expect a return to the average PE ratios we’ve seen historically.

This means that the market will probably under-perform until prices sober up. Jack Bogle, the founder of Vanguard, estimates that we will only see 4% returns over the next 10 years. Meanwhile, economist blogger Big ERN, forecasts the next 10 years will see about 6% returns.

Of course, these are just forecasts. Much like how my local weatherperson can use statistical data to forecast how much snow we’ll get, it’s a well-educated guess.

Using the CAPE forecast

A while back, I wrote about my thought process on deciding whether to pay off my student loans (I’m not.) Part of that process involved evaluating possible investments. If they could return more than my loans were costing me, I’d keep my loans and invest instead. If expected market forecasts are dropping to a 4-6% range, then paying off my 4% mortgage gets more attractive.

Also, if you’re thinking about retiring while the CAPE is high, you might want to consider using a more conservative withdrawal rate.

What to do about the market being high

While my gut might tell me to pull out of the market, I’m going to stick with my investment plan, and not with what my bowels tell me.

Trying to keep my Chickenus in check

Trying to keep my Chickenus in check

The market is made up of hard working companies that make chips, and cookies, and couches, and beer, and even deliver pizza right to your door. As long as people are still munching on those cookies, snacking on chips, watching movies, and ordering pizza, corporate profits will keep rolling in.

Just because the market keeps getting high – and crashes in the middle of parties – doesn’t mean you should bail on it. The market could be getting ready to for another meteoric session, or it might need to crash hard for a nap first. Either way, I have a feeling the market will keep getting higher over the long term. For the most part, my strategy is to ignore the data, relax, and enjoy this high-market high.